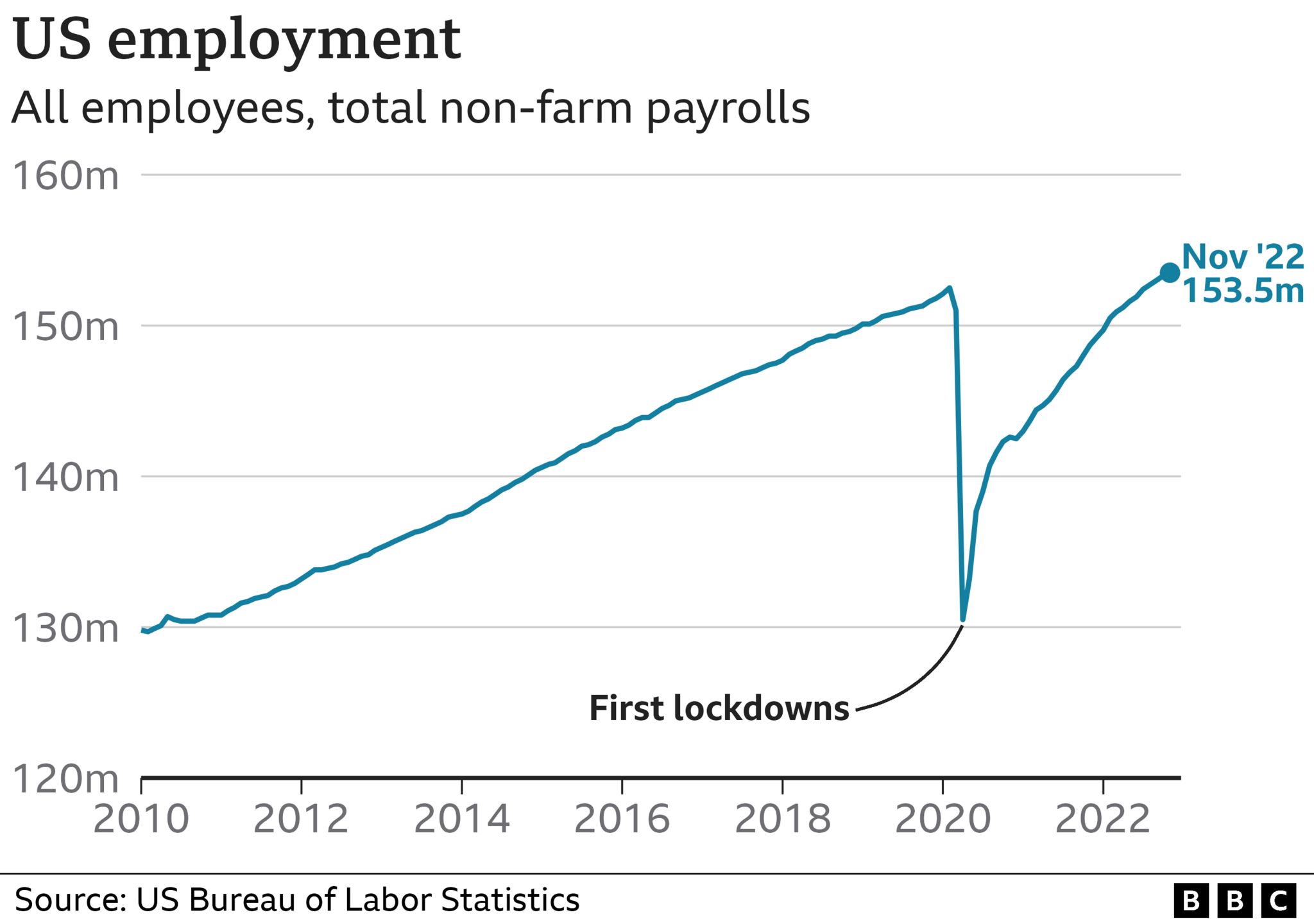

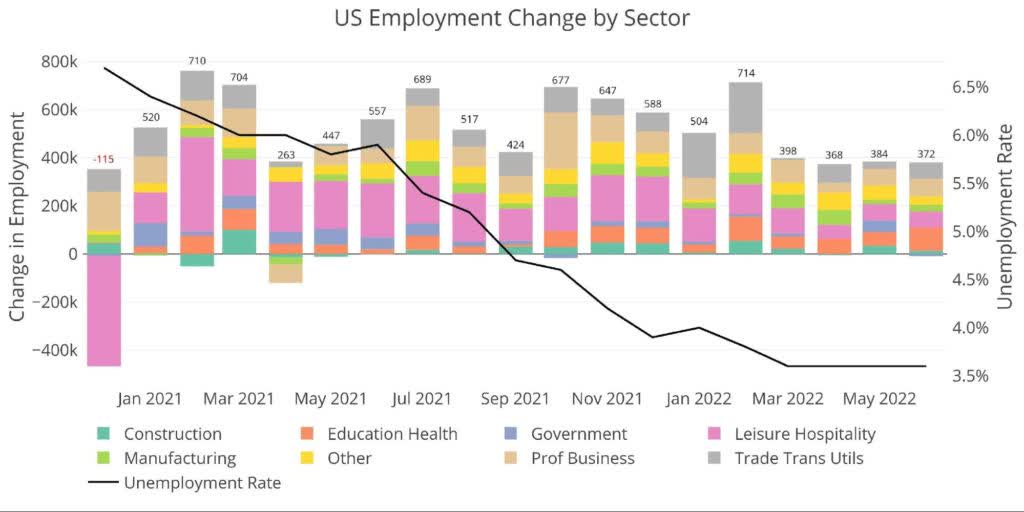

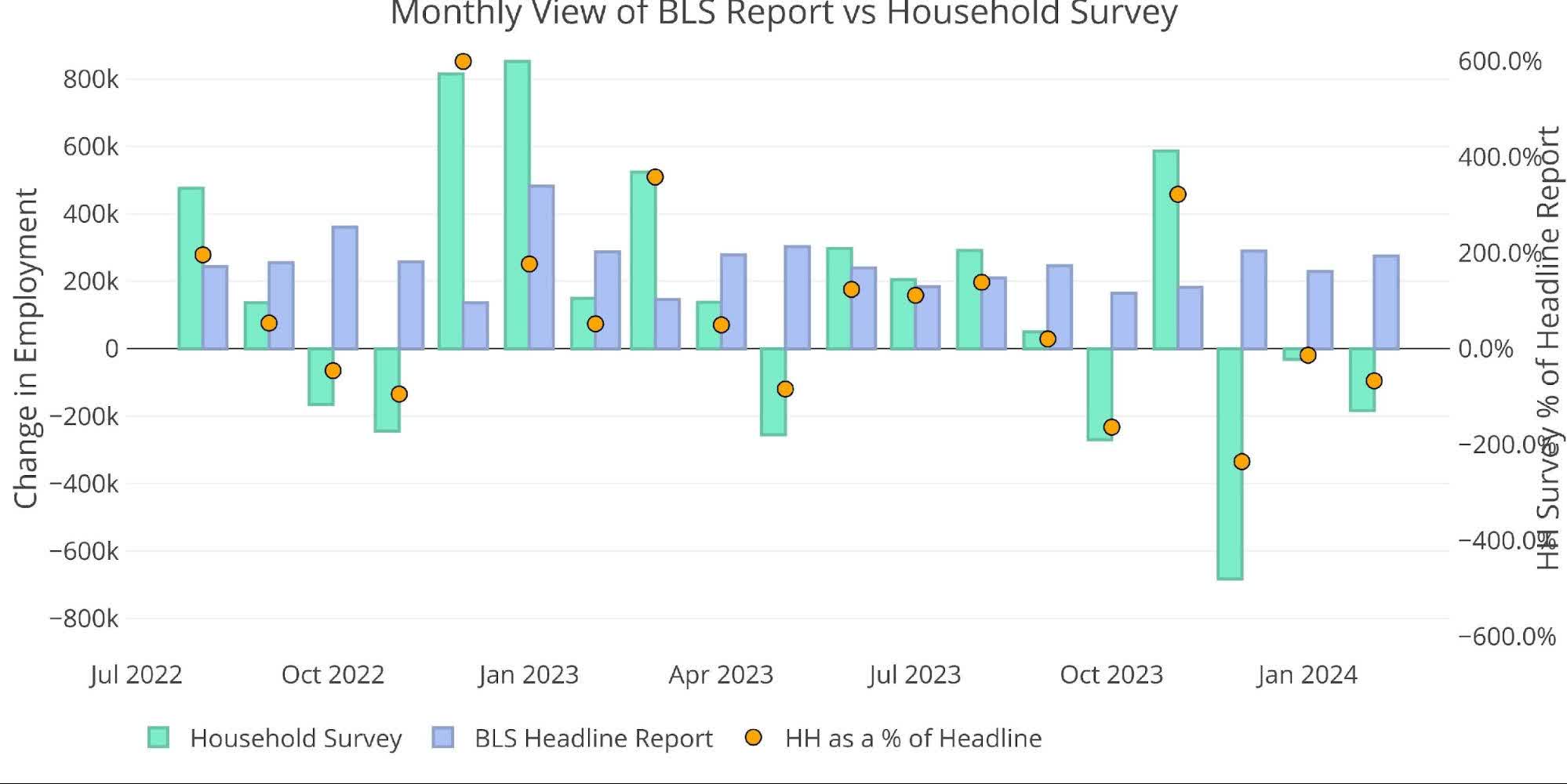

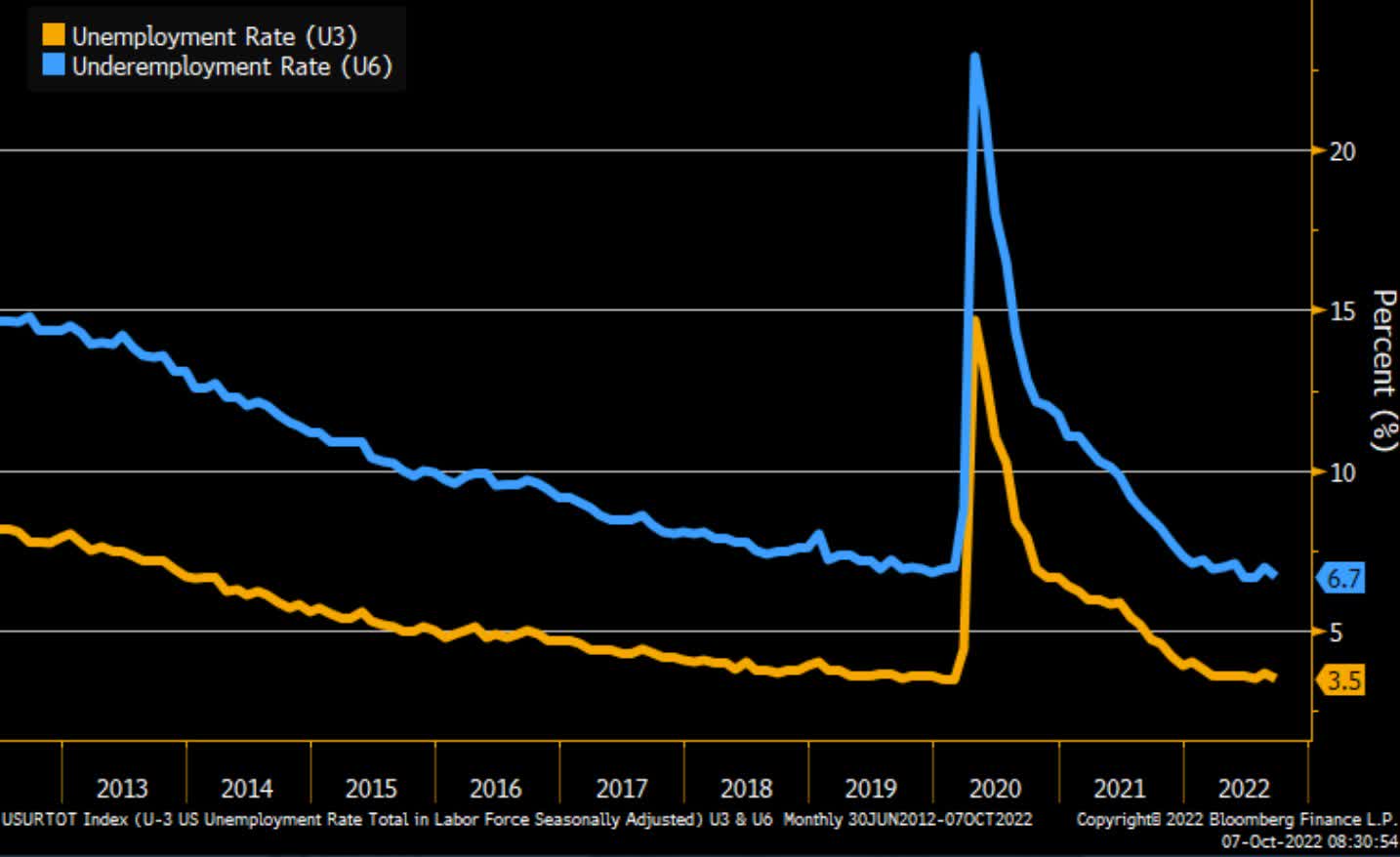

· negative revisions can be a warning sign because of the way the jobs figures are calculated. · economists and wall street investors have long considered the job figures reliable, with share prices and bond yields often reacting sharply when they are released. · as a signal that job growth has been overstated by an average of 68,000 per month during the revision period, it is more or less accurate. ‘powell is going to regret holding rates steady’ The monthly numbers are based on a huge survey of businesses and other employers. · wall street strategists are sharply recalibrating their economic outlooks after fridays july jobs report showed weaker-than-expected hiring and staggering downward … · a federal reserve official on wednesday called last weeks tepid jobs report concerning, and said its significant downward revisions could signal an economic shift in the … · shockingly bad jobs report reveals a monthslong stall and may trigger fed rate cuts soon. Wednesday’s revisions were substantial, representing a reduction of 0. 5% of of total employment from april 2023 to march. But that just brings average … · the next batch of inflation data from the bureau of labor statistics was already shaping up to be a high-profile affair due to the expected impact of president donald trump’s … Job growth in the year ending in march was 818,000 lower than first estimated, according to a preliminary revision by the labor department. Average annual revisions over the past 10 years have been within …

Your Money'S On The Line: Massive Jobs Report Revisions & Inflation Concerns

· negative revisions can be a warning sign because of the way the jobs figures are calculated. · economists and wall street investors have long...