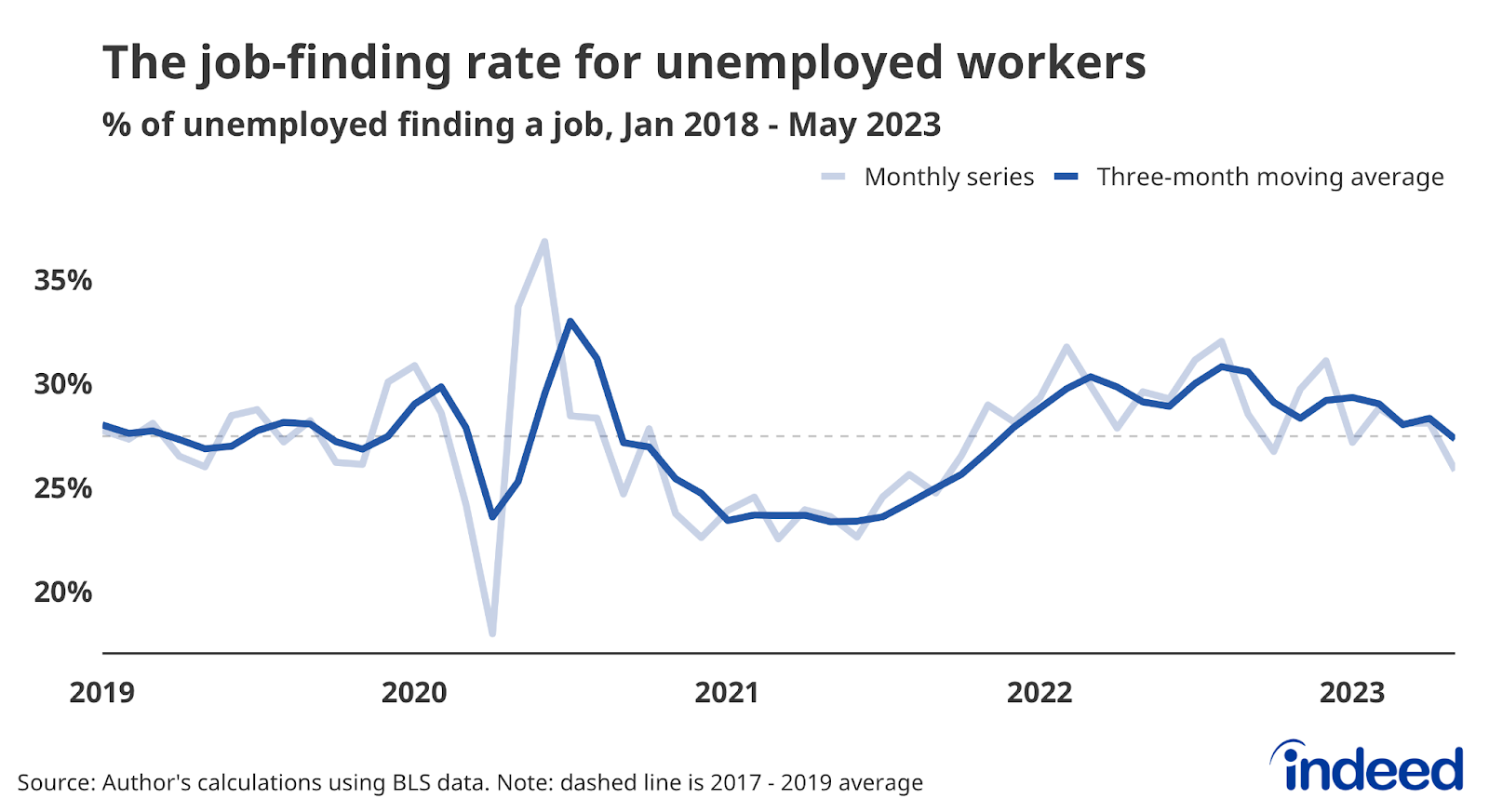

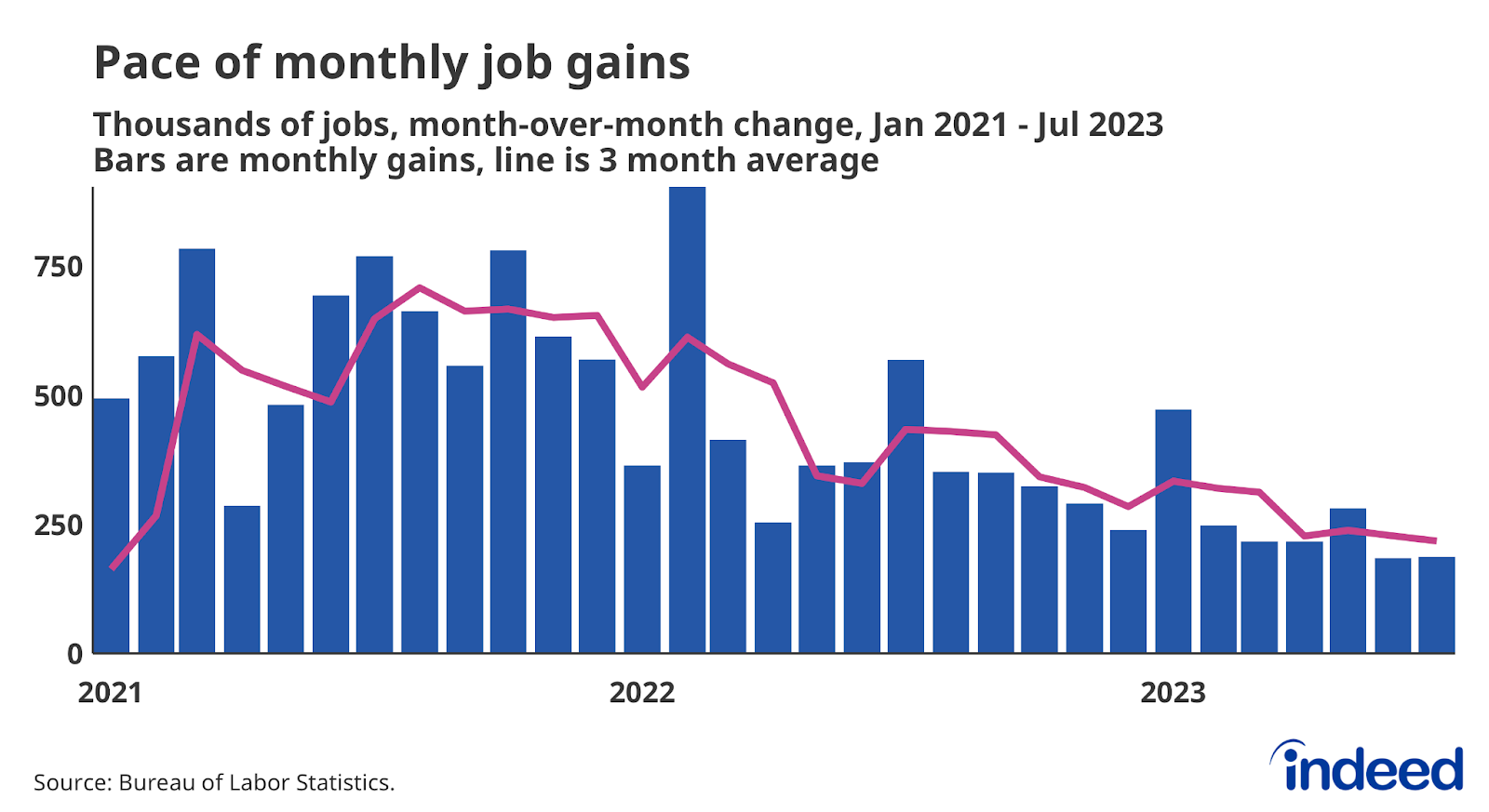

The worse-than-expected july jobs report strengthens the case for rate cuts in september, exactly one year after the central bank started its rate-cutting cycle to … · fridays unexpectedly weak jobs report signals that some sectors are cutting back on hiring amid economic uncertainty. That followed a january jobs report which was, on. · the labor market showed signs of weakening, with 73,000 jobs added in july and gains for the previous two months revised significantly lower. · consumer inflation expectations jumped amid trump tariff threats, the university of michigan consumer sentiment index showed on friday. · september’s report has suddenly changed expectations for the fed’s trajectory, as the market now sees four 25 basis point rate cuts over the next four meetings and a higher … Employers hired far more workers than expected in january, a staggering flex of economic strength that refutes worries of a recession but could delay highly-anticipated interest rate cuts. The july jobs report dramatically … Economy suffered an unexpected setback in july, as hiring fell sharply and the unemployment rate rose for the fourth straight month in a sign that higher interest rates may be taking a bigger toll on businesses and consumers. · after months of warnings from economists and weakening data from the private sector, federal jobs numbers have caught up to the concern. · why it matters: · the november jobs report exceeded economists expectations by a wide margin, fueling investor anxiety that the federal reserve wont be pivoting away from its hawkish … · the next batch of inflation data from the bureau of labor statistics was already shaping up to be a high-profile affair due to the expected impact of president donald trump’s hefty …

The Jobs Report'S Unexpected Impact: A Look At Inflation'S Trajectory

The worse-than-expected july jobs report strengthens the case for rate cuts in september, exactly one year after the central bank started its rate-cutting cycle to...