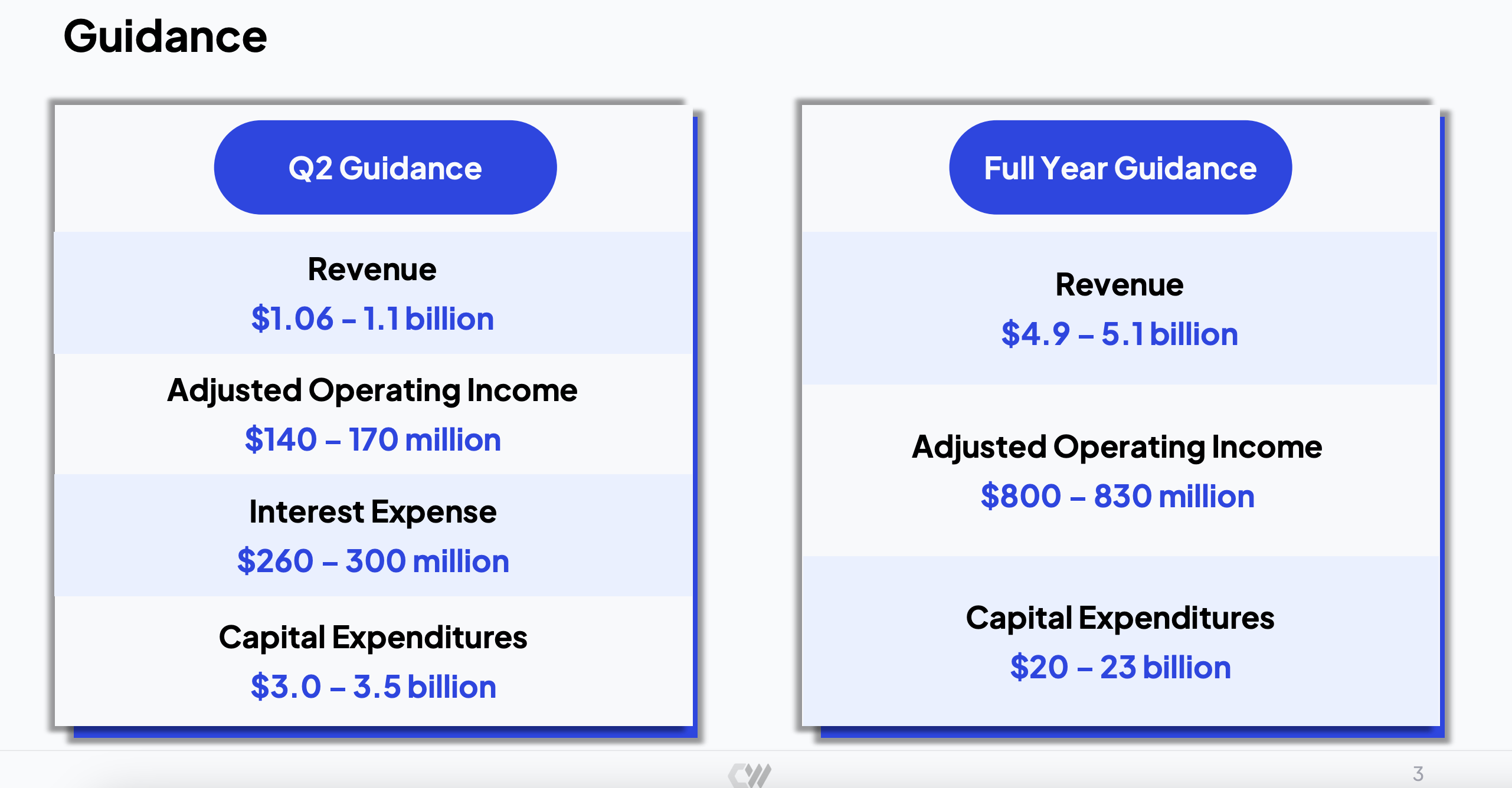

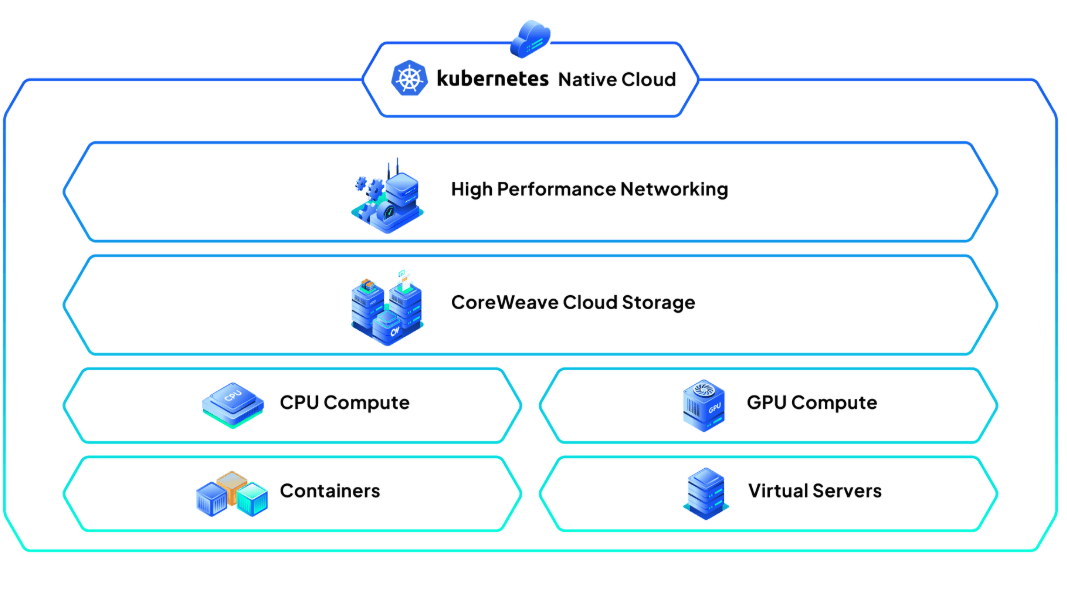

· coreweave reported $982m in q1 2025 revenue (+420% yoy) and guided to ~$5b for fy25, backed by a $25. 9b backlog. · coreweave is highly reliant on microsoft for revenue. · as previously detailed, coreweave’s prospectus indicates that the lockup period for 84% of its shares expires on “the close of trading on the second trading day after the date that … The lockup period for coreweave stock tied to the companys ipo expires thursday, earlier than usual. Since 2017, coreweave has operated a growing footprint … · coreweave rebounded sharply post-ipo, alleviating initial fears about debt and customer concentration with strong q1 results and surging ai demand. Key growth drivers include $16b+ in openai contracts, a … Coreweave is a otc stock, trading under the symbol crwv-q on the (). Following a quadrupling for coreweave … · coreweave (crwv) reports second quarter results after tuesdays closing bell. It is usually referred to as or crwv-q · coreweave reports q2 earnings tuesday. · the companys technology provides enterprises and leading ai labs with cloud solutions for accelerated computing. Heres how early investors and employees with stock options could benefit—and what to watch for after the 6-month lockup. · coreweave, one of the year’s hottest technology ipos, will report its fiscal second-quarter financial results after the market closes. Investors are hoping for more positive news … · coreweave will host an audio webcast to discuss the results for the first quarter of 2025, provide a business update, and forward-looking guidance at 2:00 pm pt / 5:00 pm et … · coreweave priced its ipo at $40. · the answer will hinge on how much coreweave will manage to bind its developer stack to its fleet of hardware, applying switching costs that will exceed pure pricing. Yahoo finance executive editor brian sozzi outlines what investors need to see in the earnings … · artificial intelligence infrastructure provider coreweave reported better-than-expected revenue on wednesday in the company’s first earnings release since going public. Coreweave (crwv-q) frequently asked questions what is coreweave stock symbol? If the stock rallies on short-covering, exit 50% of the position once it surpasses $180 (a 20% gain from … · tactical exit strategy the lockup expiration is a double-edged sword. The ai hyperscaler has … Plus, soon insiders will be able to sell shares after the post-ipo lockup period expires. Several analysts cut their ratings · on its earnings call, coreweave is likely to face questions about its proposed all-stock acquisition of data-center operator core scientific inc.

The Coreweave Question: Earnings And Lockup – What'S The Answer?

· coreweave reported $982m in q1 2025 revenue (+420% yoy) and guided to ~$5b for fy25, backed by a $25. 9b backlog. · coreweave is...