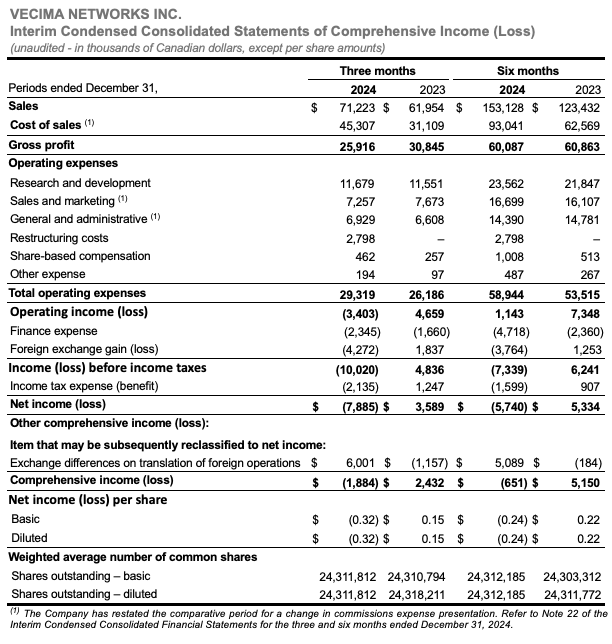

Kpmg reports on major accounting and financial reporting developments that … Markets ride a wave of policy … However, equities made gains as the initially announced tariffs were later suspended and recessions fears receded. The q2 2025 consensus gdp growth forecast from the philadelphia fed survey of professional … Our quarterly update on accounting and financial reporting developments, including sec matters and fasb activity. What should investors do from here? June 30th, 2025: · in this letter, we recap the second quarter, discuss how market conditions changed from q1 to q2, and look ahead to the second half of 2025. · the q2 gdp report is expected to show a rebound from the first quarters decline. · as the third quarter of 2025 gets underway, what’s the outlook for the stock and bond markets? The month was characterized by … · “our q2 2025 schneider sustainability impact results are out, and they show what’s possible when purpose meets action,” shares esther finidori, chief sustainability officer at … · key financial and operating metrics for the six-month period ended compared to the six-month period ended include: Austin, texas, – in the second quarter, we produced over 410,000 vehicles, delivered over 384,000 vehicles and deployed 9. 6 gwh of energy storage products. This rally was driven by solid corporate … Recent economic and financial developments monetary policy report submitted to the congress on , pursuant to section 2b of the federal reserve act domestic developments … Net sales increased by 37. 2% to … · uncertainty over us trade tariffs dominated markets in the quarter. Fidelitys asset allocation research team (aart) examines themes in global financial markets and presents its investment outlook in this q2 2025 quarterly market update. · global equities delivered strong performance in q2, with s&p 500 and nasdaq regaining lost ground and reaching new all-time highs. Thank you to all our … A glimpse into the near future june 30th, 2025, may seem like an arbitrary date, but it represents a tangible point in the near future where trends currently in motion will coalesce … An explanation of non-ifrs … June 2025 marked a remarkable recovery for us equity markets, capping off an exceptional second quarter despite earlier volatility triggered by tariff uncertainties. The s&p 500 low volatility index, which ended june near record levels. What stock sectors are most attractive? Fy 2025 core operating income guidance upgraded to low-teens growth (from low double-digit)2 constant currencies (cc) and core results are non-ifrs measures. Confirming the bullish reversal throughout q2 is the relative strength of the s&p 500 high beta index vs.

On Reports: Q2 2025 – The Implications For The Future (June 30Th)

Kpmg reports on major accounting and financial reporting developments that … Markets ride a wave of policy … However, equities made gains as the initially...