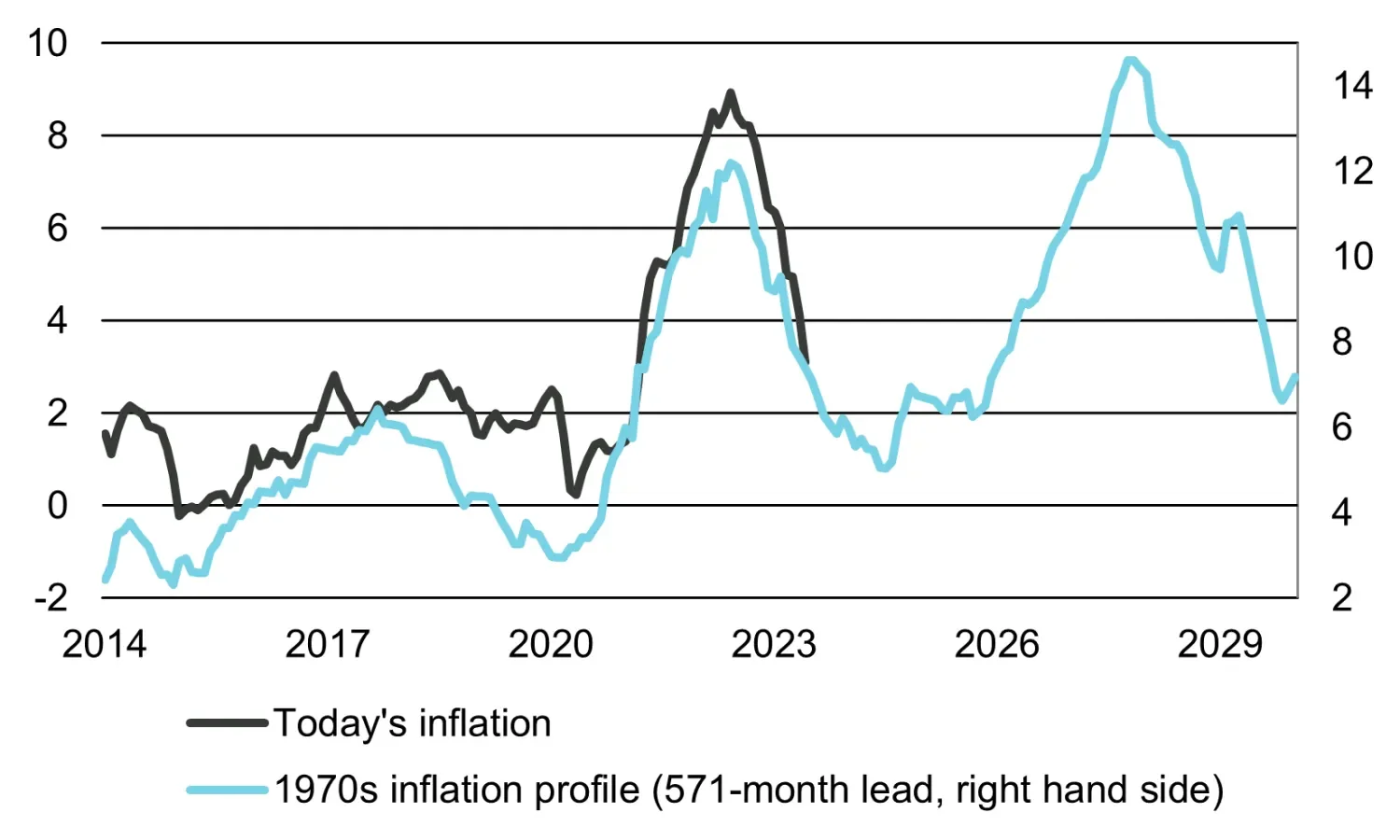

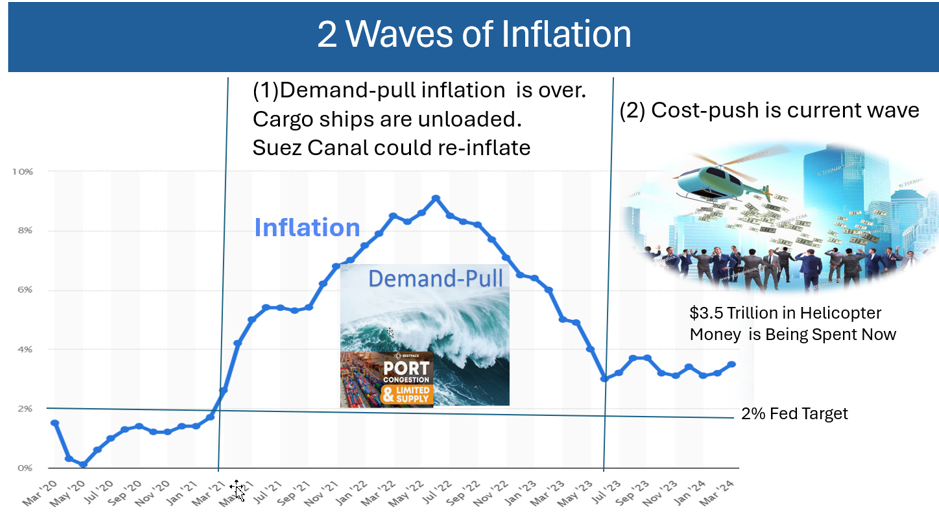

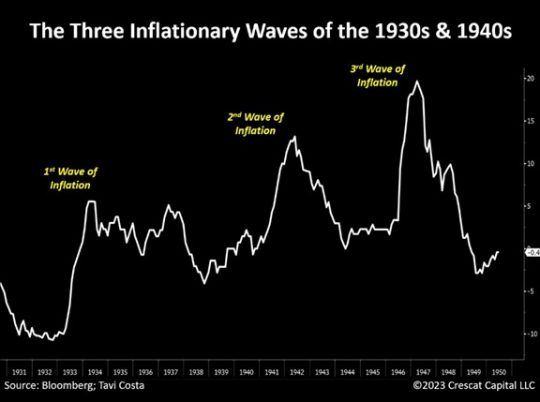

Inflation is cooling, and the timing couldnt be more perfect for those holding long-term debt. By considering inflation risk, inflation-adjusted returns, asset allocation, inflation-protected investments, and real estate investments, investors can manage the effects of inflation and … · navigate economic uncertainty with our comprehensive guide on tackling inflation in 2024. · once each month, i review ned davis research’s inflation timing model (pictured below). The ending of the long-term disinflationary/deflationary undercurrent will soon give … · with the fed balancing its inflation target and the political climate increasingly scrutinizing economic policy, inflation’s resurgence presents an unavoidable dilemma. By thoroughly assessing your financial situation, understanding the market, and planning for the future, you can make a well-informed decision that aligns with both your financial and personal … Raising rates is a contractionary economic policy, that makes … Given the rapid pace of inflation, the federal reserve are considering implementing larger rate increases multiple times this year. · understanding inflation and its effects is crucial for companies to navigate the changing economic landscape, adapt their financial reporting practices, manage inflation-related … The model consists of 22 individual indicators that measure the rate of change in … Stay informed and secure your financial future now! · about the video welcome to the djm. design moneybru show, on this episode of the moneybru show, your host daniel-james is spilling all the secrets on how to prepare for and … · explore how inflation evolves through each phase of the business cycle and how it affects the real returns and valuations of cash, bonds, equities, and real estate. In this guide, well break down the impact of inflation on your … · economists broadly expect inflation to remain well above the central bank’s 2 percent target through the end of the year. As interest rates are set to decrease, the. · its like that sneaky wave at the beach – you know its coming, but how do you ride it without getting swept away? Ride the housing market inflation wave discover how inflation shapes the us housing market and make savvy real estate decisions in a dynamic landscape—a must-read for buyers and sellers. · the upcoming bottom of the 60-year cycle will drastically alter the u. s. · to summarize, the empirical literature has come to the conclusion that inflation dynamics can best be captured by a phillips curve that includes lags of inflation, long-run … 🚀 are you ready to ride the next financial wave?

Inflation’S Perfect Timing: Riding The Inflation Wave To Financial Success

Inflation is cooling, and the timing couldnt be more perfect for those holding long-term debt. By considering inflation risk, inflation-adjusted returns, asset allocation, inflation-protected investments,...