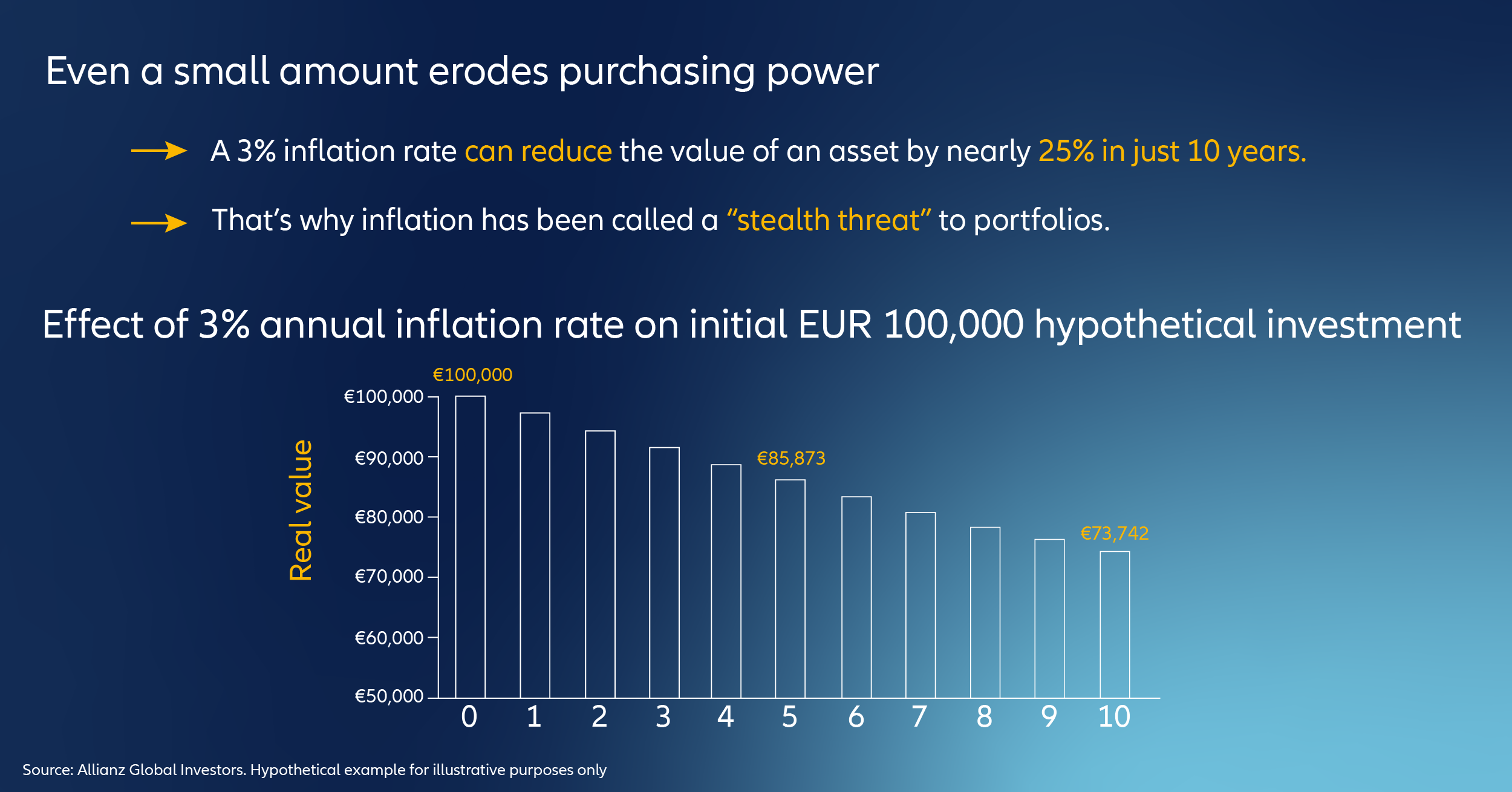

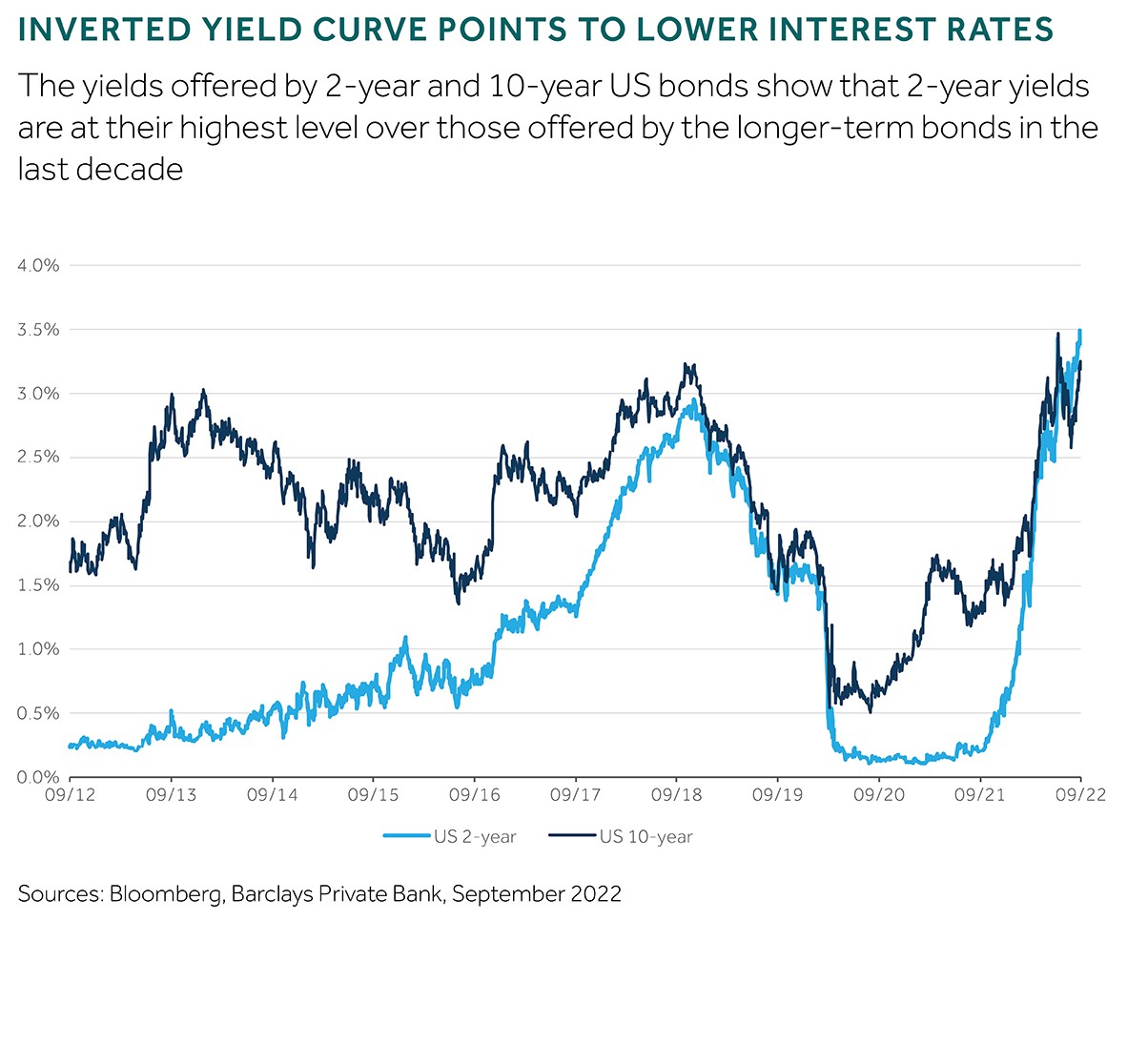

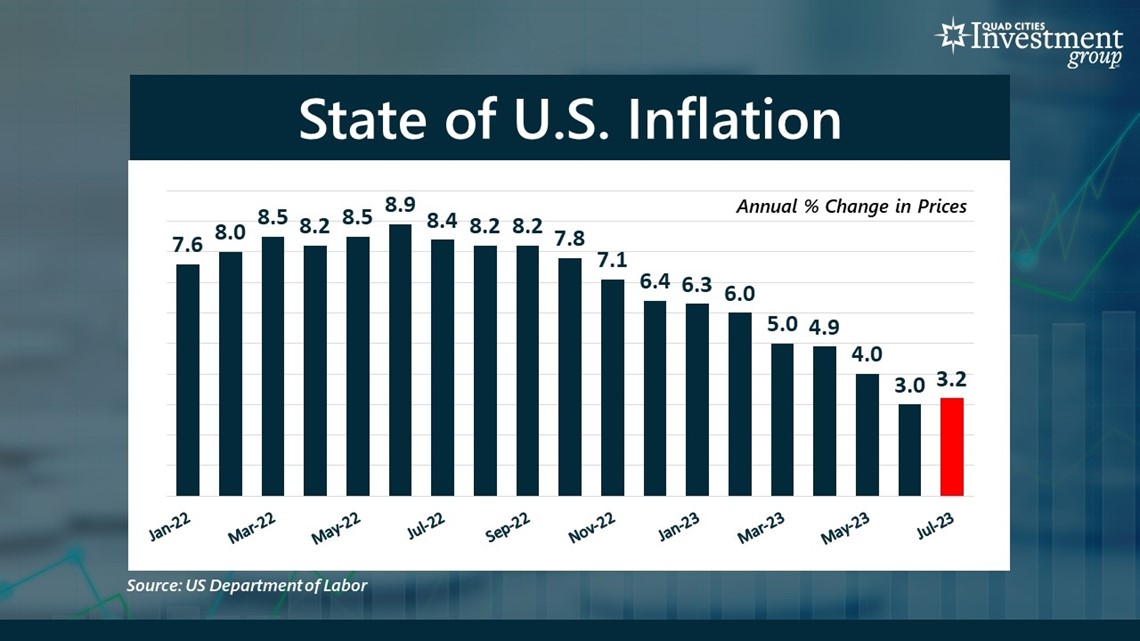

Inflation in the us was more than 8% in september and 10. 1% in the uk. · the may 2025 chief economists outlook explores key trends in the global economy, including the latest outlook for growth, inflation, monetary and fiscal policy. Dismal stagflation in the 1970s forced a broad shift in thinking believed to better protect economies from the malady. · equally, if inflation drops, trade could also blossom on the back of revised monetary policies. · the global economy was front and centre in 2024, as leaders grappled with challenges like inflation, multiple elections and the intelligent age. But it’s not just a game that millionaires play. · when it comes to slow cooking a pork roast, the key to achieving tender, juicy, and flavorful results lies in the cooking time. The rise has been driven in large part by pent-up consumer demand after the pandemic and the russian invasion of ukraine. · inflation is the term used to describe the rate at which prices increase. The latest data shows that us inflation is up around 8% year on year (an average rate), but some sectors like energy, 26%, and used cars, 42%, are experiencing drastic price increases, which are hurting everyday consumers. · anticipation has grown for an onset of stagflation,’ a toxic blend of deteriorating growth and rising inflation, in the us and elsewhere. A perfectly cooked pork roast can be the centerpiece of a delicious meal, but overcooking or undercooking it can lead to disappointment. Starting not only in 2021, but today. It’s in the headlines because it has been rising at the fastest pace for several years across many countries. However, the economic outlook remains uncertain, with expectations the global economy will weaken in the coming year. It underlines the exceptional uncertainty of the current economic environment, highlights key drivers and impacts, and discusses the compounding effect of an ongoing ai revolution. While inflation is easing in most regions, uncertainty remains elevated and regional growth disparities shape an overall subdued outlook. But it ‘isn’t just a relic of the past,’ says ey chief economist gregory daco, particularly at a time of greater government. · discover how to invest in precious metals like gold and silver. Economic factors like new us tariffs are redrawing trade maps, while the energy transition shows progress and gender gaps persist. You can play the real estate investing game too. In this article, we will delve into the world of slow cooking a pork roast, exploring the factors that affect cooking time. The primary way of … Inflation is a buzz word that has come to the forefront of economic discussion over the past twelve months and it’s currently very real. Learn about bullion, pricing, safe storage, and why these assets remain a timeless hedge. · real estate happens to be the #1 alternative asset trusted and owned by the overwhelming majority of millionaires. These seven charts from world economic forum reports help illustrate the inflection points this. · the global risks report 2025 analyses global risks to support decision-makers in balancing current crises and longer-term priorities. Whether you are preparing to capitalize on “business 2025” or setting the stage for future opportunities, aligning market readiness and strategic use of technology gives you the edge you need. · inflation is on the increase around the world, with food and energy prices hitting record highs. The perfect timing to buy or sell making a well-timed decision when buying or selling a business can significantly impact your financial outcome. Ubs chief economist paul donovan explains why inflation is high and when we can expect that to ease. For millennials, this is their. This series of reports draws on the individual and. · so far, this year has been marked by significant global shifts, including increased geopolitical instability, the accelerating impact of ai and a changing labour market. · inflation has rocked post-pandemic economies throughout the world, resulting in central banks raising interest rates to levels rarely seen in decades. Us policy is expected to have a significant impact on the global economy in the years ahead, inducing a long-term shift to its trajectory. The january 2025 edition of the chief economists outlook reveals a global economy under considerable strain. In a geoeconomic environment characterized by isolationism, conflict and fragmentation, is it time to rethink approaches to inflation, drawing from the past, to better protect economies of the future? That compares with the roughly 2% most policymakers accept is a stable rate. The world economic forum’s september 2023 chief economists outlook shows signs of optimism about easing inflationary pressures.

Inflation’S Perfect Timing: Inflation’S Perfect Timing: The Ultimate Investment Guide

Inflation in the us was more than 8% in september and 10. 1% in the uk. · the may 2025 chief economists outlook explores key...