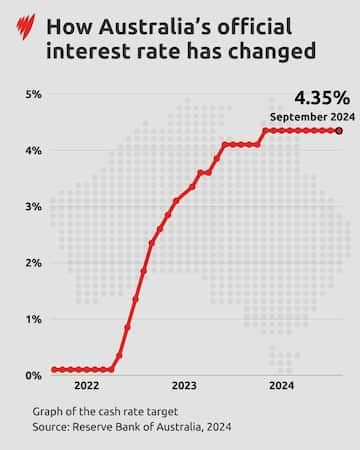

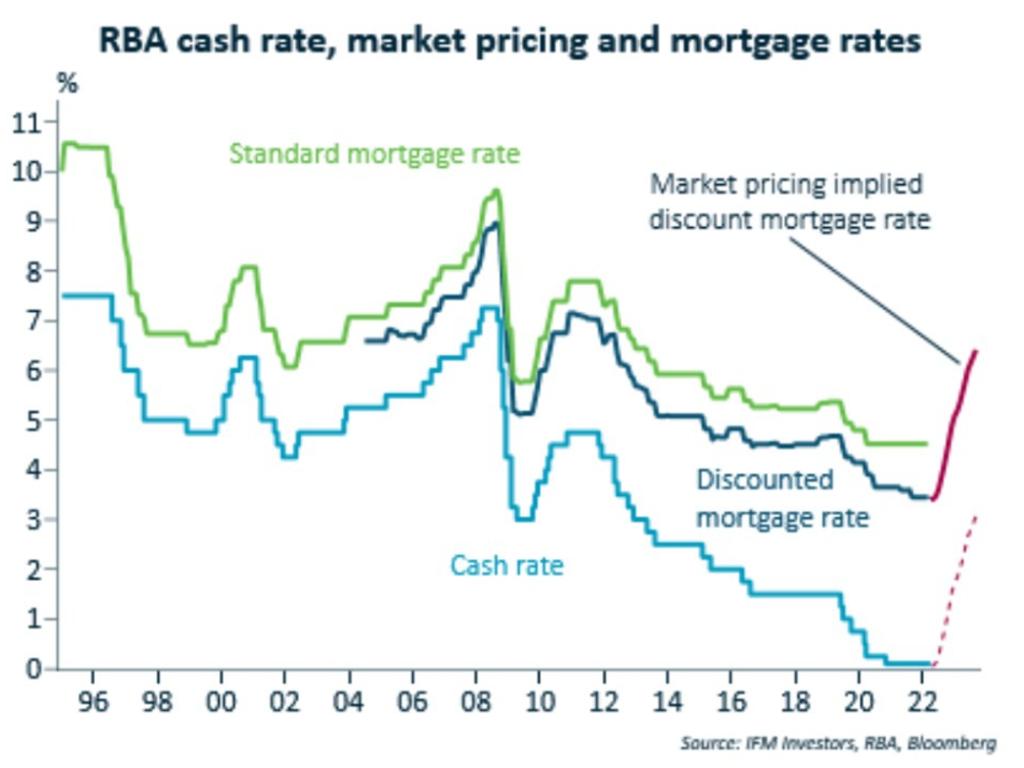

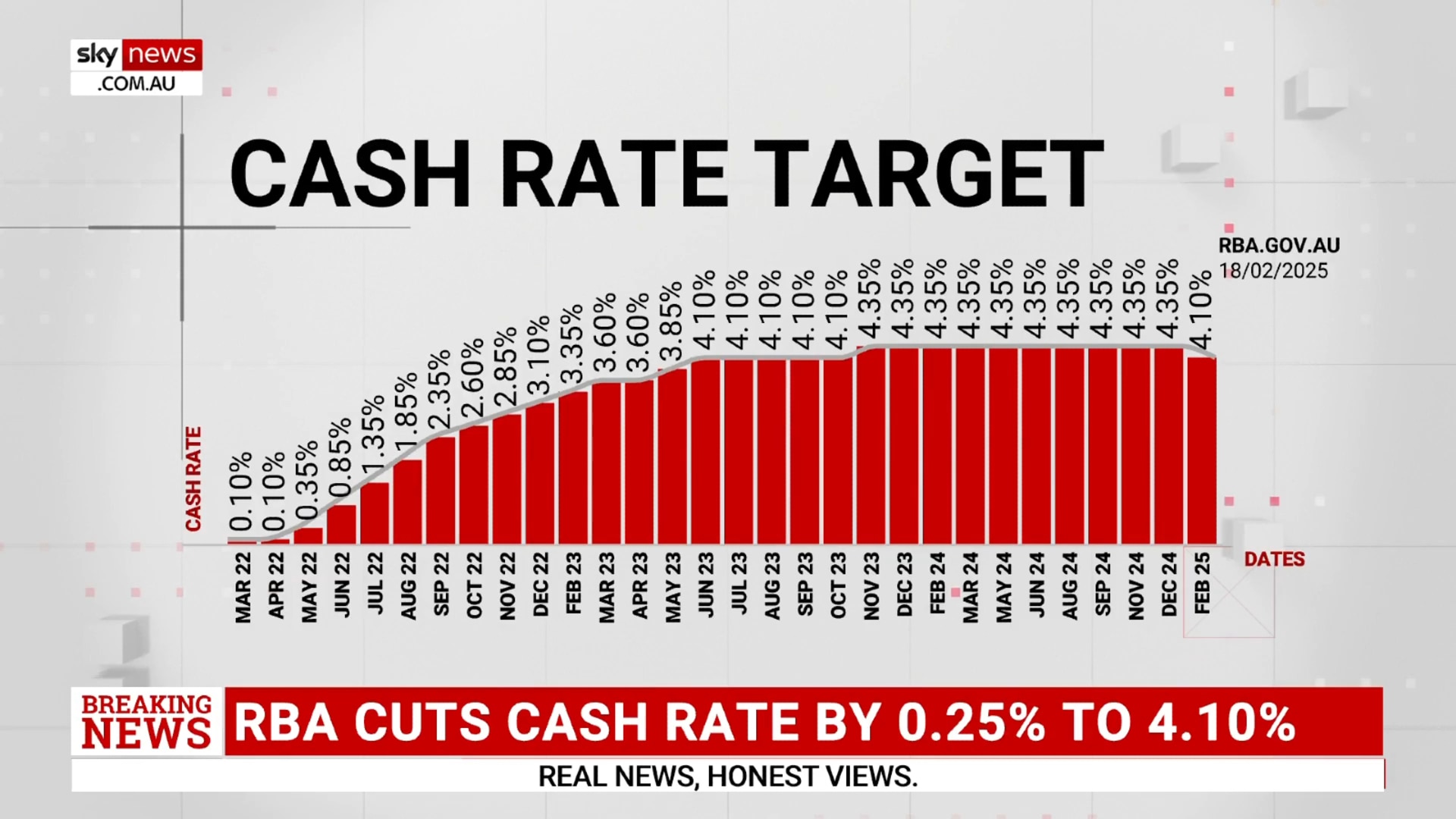

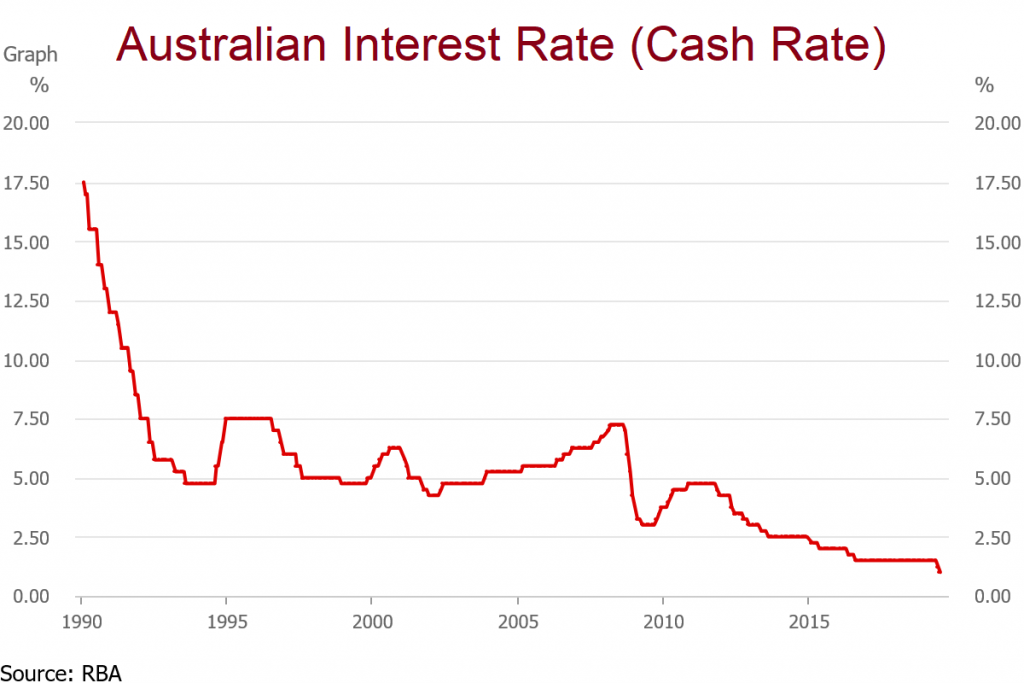

· aussie homebuyer budgets could be up to $20,000 better off after an expected reserve bank interest rate cut today, but they’ve been warned to watch out for sellers jacking … · with the reserve bank of australia (rba) set to announce the new cash rate target on tuesday, many economists and the big four banks are anticipating a rate cut of 0. 25 per cent. · australias cash rate has fallen another 25 basis points to 3. 60% – marking the third drop of this year so far – and will likely trigger another round of home loan interest rate cuts. · for australian mortgage holders, particularly those with variable rate loans, this rate cut could mean a significant decrease in their monthly repayments. Heres your handy guide to what the rba cut means for you. · the rbas widely expected interest rate cut will bring mortgage relief to millions of australians. · the rba has cut the cash rate by 25 basis points. Lower interest charges – ok, it sounds obvious, but dropping interest rates mean lower interest charges per month. Discover what this means for your repayments, property investment, and for first-home buyers in australia. · savers are still in the dark, with only two lenders announcing cuts to savings rates. If banks choose to … The rba has cut the cash rate to 3. 60%. What does a third rate cut mean for homeowners? While this change brings relief for borrowers, it’s important to make thoughtful, … · the rba’s decision to cut rates marks a significant shift in australia’s economic landscape. In response to easing inflation and a … An official interest rate decrease usually means … A number of banks have already promised to pass on the cuts, but not all … However, questions remain over when - … · westpac has confirmed it will reduce variable home loan rates by 25 basis points, in line with the reserve bank of australias (rba) latest cash rate cut. And lower interest charges generally occur as soon as your lender drops … Discover what does this mean for you, and see if your lender is passing on the cut? · the interest rate cut is big news in australia because the cash rate is one factor in lenders setting of variable mortgage rates. · the reserve bank of australia (rba) has cut the cash rate by 25 basis points to 3. 85%, delivering potential relief for mortgage holders. If you have a $600,000 mortgage with 25 years remaining, this 0. 25 per cent rate cut will save you roughly $74 per month, if your lender … · the reserve bank of australia (rba) has announced its interest rate decision following the board meeting on 11-12 august 2025.

Australia Cuts Interest Rates: What Does It Mean For Your Mortgage?

· aussie homebuyer budgets could be up to $20,000 better off after an expected reserve bank interest rate cut today, but they’ve been warned to...