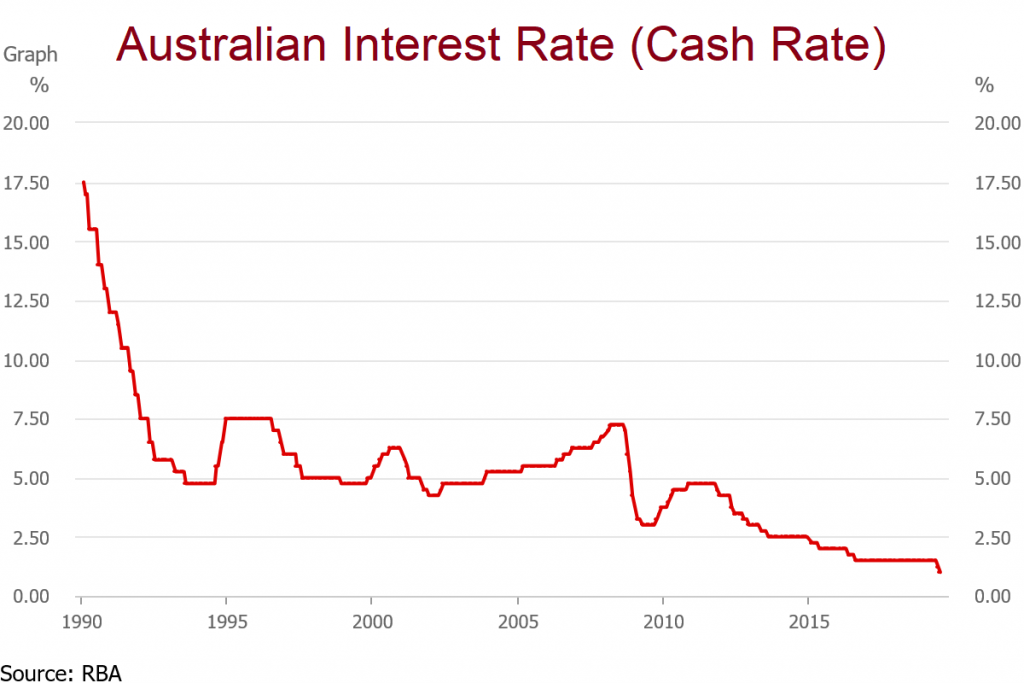

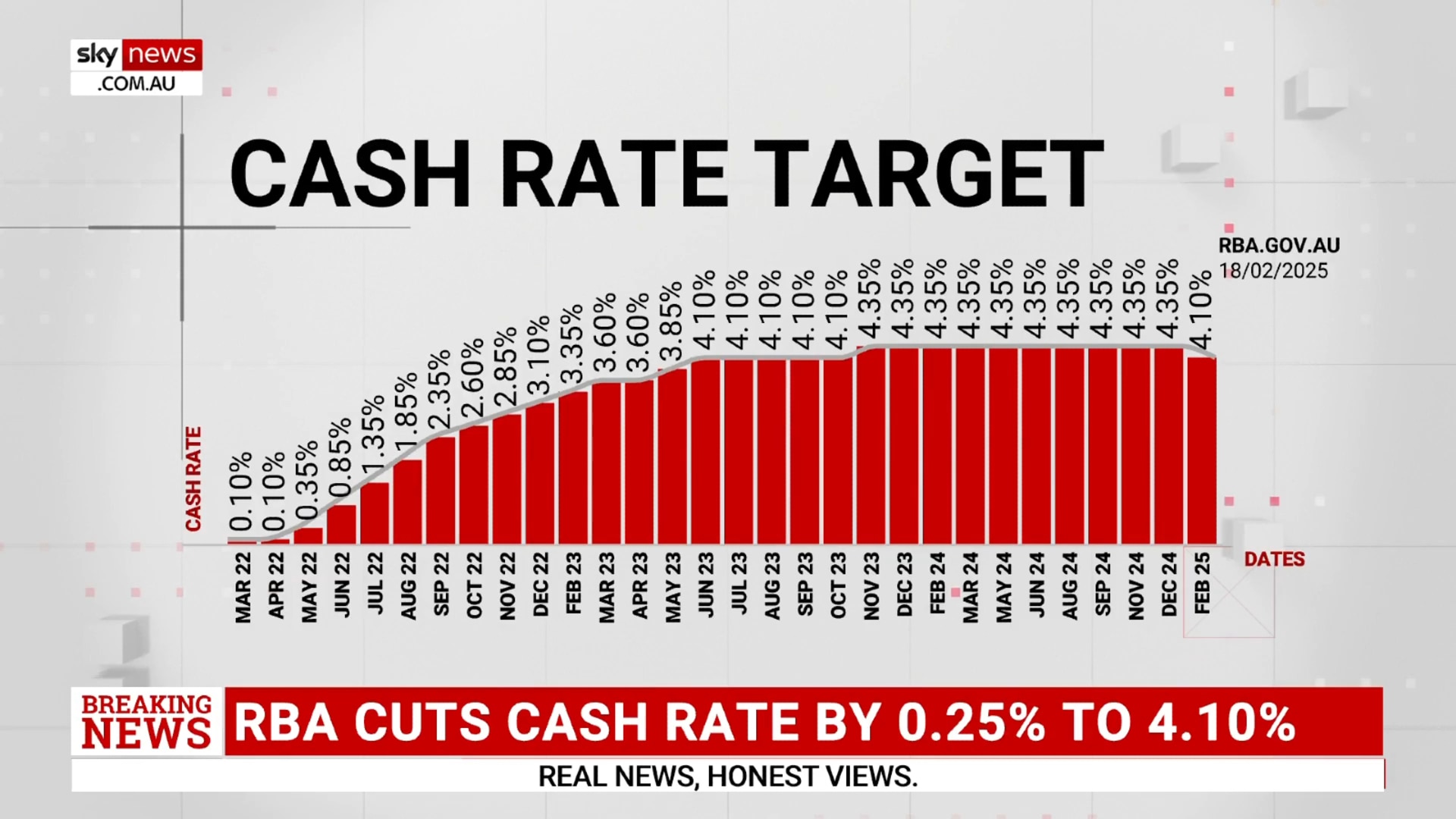

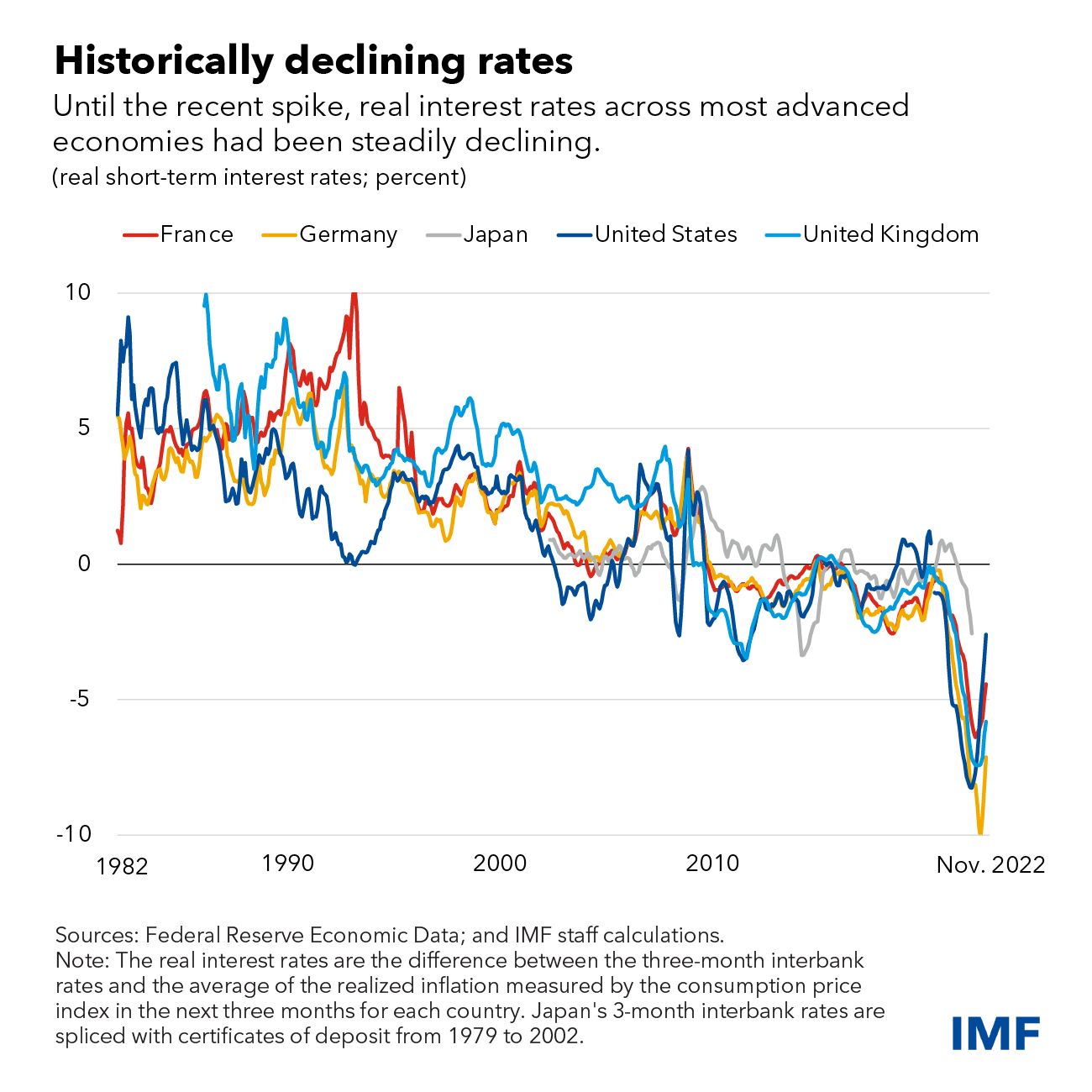

The reserve bank of australia reduced its economic growth forecast for the year to 1. 7% from 2. 1%, saying that a weaker-than-expected rise in public demand in early 2025 was unlikely to … · oecd’s long-term interest rates forecast for australia also predicts a decline in rates throughout 2025, with rates hitting the 3. 1% mark by the end of 2025. While bold policy decisions during times of … · the reserve bank of australia (rba) has cut interest rates for the first time in over four years, lowering the cash rate from 4. 1% to 3. 85%. While providing immediate relief to borrowers, the long-term effects … · the reserve bank of australia has finally delivered the third rate cut this year after holding rates last month in a move that shocked mortgage holders and economists. Explore its impact on inflation, markets, future rates, and consumer finances. · while this will give some relief to mortgage holders, it will also impact those with other types of loans, as well as interest rates on savings accounts. · the decision to cut interest rates in australia has significant effects on the economy, particularly for those looking to buy a home or manage their mortgage loans. · australia’s central bank has reduced its benchmark interest rate by a quarter percentage point for a third time this year to 3. 6%, with inflation tamed and economic growth … · the reserve bank of australia has downgraded the long-term outlook for productivity growth and warned the economy is incapable of sustainably growing faster than 2 … · within minutes of the reserve bank of australia announcing it would cut interest rates on tuesday, the major banks were quick to share they were following suit. Check to see how the major banks are reacting — and what that means for savers and mortgage holders. · discover how the reserve bank of australia influences the economy via interest rates, impacting mortgages and investments. This 0. 25 percentage point reduction … Here, they break down how delayed tax … The rba’s recent interest rate cut reflects a shift in monetary policy as inflation eases and economic growth slows. · the federal budget 2025–26 delivers short-term stability but risks long-term vulnerabilities, according to commbank economists. · interest rates have gone down by 0. 25 percentage points. · in summary, the rba’s latest rate cut is seen as a ‘shocking’ move that could reshape australia’s overall economic landscape. · the rba cut rates to 4. 10%, ending the tightening cycle.

Australia Cuts Interest Rates: What Are The Long Term Effects?

The reserve bank of australia reduced its economic growth forecast for the year to 1. 7% from 2. 1%, saying that a weaker-than-expected rise in...